In a famous 1995 pronouncement that has since become a Silicon Valley trope, Jim Barksdale, the CEO of Netscape at the time, declared that there are two ways to make money in business: bundling and unbundling. That is, many ventures seek profit by repackaging existing goods and services as revenue streams they can control, with technology frequently serving as the mechanism. The tech industry’s mythology about itself as a “disruptor” of the status quo revolves around this concept: Inefficient bundles (newspapers, cable TV, shopping malls) are disaggregated by companies that serve consumers better by letting them choose the features they want as stand-alone products, unencumbered of their former baggage. Why pay for a package of thousands of unwatched cable television channels, when you can pay for only the ones you watch? Who wants to subsidize journalism when all you care about is sports scores?

Media has been the most obvious target of digital unbundling because of the internet’s ability to subsume other forms and modularize their content. But almost anything can be understood as a bundle of some kind — a messy entanglement of variously useful functions embedded in a set of objects, places, institutions, and jobs that is rarely optimized for serving a single purpose. And accordingly, we hear promises to unbundle more and more entities. Transportation systems are being unbundled by various ridesharing and other mobility-as-a-service startups, causing driving, parking, navigation, and vehicle maintenance to decouple from their traditional locus in the privately owned automobile. Higher education, which has historically embedded classroom learning in an expensive bundle that often includes residence on campus and extracurricular activities, is undergoing a similar change via tools for remote learning.

As the restaurant fragments, the home becomes a new sort of bundle

Unbundling has gained traction as a rationale because of its potential, in certain cases, to extract what is useful or valuable for consumers from the once necessary infrastructure that delivered it. But the tech industry, in its continuing eagerness to unlock new revenue sources by unbundling more of the world, has been driven to look beyond the low-hanging fruit. Restaurants are as pleasant and functional as they have ever been, for the most part. Yet from these unbundlers’ perspective, restaurants are inefficient bottlenecks that limit the throughput of food. The solution to this “problem”? For one, replace restaurants with something more like food fulfillment centers — assembly-line-driven fast-casual chains and food halls. These suggest a technologized approach to food provision, but the startups working to streamline this process can go much further, disaggregating meal preparation, service, and the food’s ultimate consumption altogether with delivery apps and “ghost kitchens.”

This approach to selling food squeezes more revenue out of each square foot of real estate, which is no longer bogged down with diners lingering over meals and conversation. To the extent that such unbundling decreases costs — and many food delivery startups still lose money — those savings are not passed along to consumers as correspondingly lower prices. Instead, those consumers get “convenience,” marketed as a luxury. Eating cooled-off restaurant food alone at home in front of a screen is a privilege for which we should pay more, we are told.

The Atlantic’s Derek Thompson calls this “convenience maximalism,” and it functions as an important ideological justification for unbundling, providing a reason to dislodge activities like eating from their familiar settings. But who benefits most from this convenience? More than the people ordering and eating the food, it’s the companies doing the unbundling, who shift labor formerly done by employees onto gig workers or the customers themselves. As the restaurant fragments, the home itself becomes a new sort of bundle, internalizing pieces of activities that previously happened in public. Even if this bundle is unquestionably more convenient, its overall superiority to the things it replaced is unclear. As Thompson argues, food delivery and the broader convenience industry serve as a support system for an overworked urban professional class, who are “too busy and depleted to cook.”

The rationale of convenience helps disguise the fact that many unbundling efforts offer no particular benefit to end users and proceed according to a purely exploitative logic. When the tech industry sets its sights on existing bundles that people like and that are still financially sustainable, this suggests that the desire for profit has usurped the pretense of consumer welfare. Without that alibi, unbundling appears as naked greed, delivering increased returns to a select few without necessarily improving anything for anyone else, and quite possibly making things worse.

Many unbundling efforts offer no particular benefit to end users

In this, unbundling resembles the machinations of the private equity industry, which, as Matt Stoller writes, “transforms corporations from institutions that house people and capital for the purpose of production into extractive institutions designed solely to shift cash to owners and leave the rest behind as trash.” The ostensible purpose of private equity is to buy poorly performing companies and restructure them into better versions of themselves. In practice, however, private equity also targets healthy companies for acquisition, frequently financing buyouts with debt that the purchased company will end up owing, and then stripping out the company’s most valuable assets or repositioning them to maximize financial returns for the buying firm.

The bankruptcy and liquidation of Toys ‘R’ Us in 2018 illustrated this dynamic: The company wasn’t unbundled because better alternatives had emerged but because a consortium of investors including Bain Capital had bought it and reoriented its operations around amassing debt and funneling money to its new owners. Toys ‘R’ Us was popular until its demise, contrary to the narrative that Amazon alone had undermined it. Private equity simply unbundled the company into a set of assets independent of, and at odds with, its actual business.

In 1929, G.K. Chesterton warned against dismantling something that has existed for a long time — such as a fence — just because its purpose is not apparent. In quintessential conservative fashion, he argued that it’s better to err on the side of the status quo, leaving the fence standing until the reason it was built is better understood. Today, in the fervor to unbundle, the fallacy of Chesterton’s fence runs rampant. Any doubt about some established arrangement’s holistic purpose is considered reason enough to take it apart.

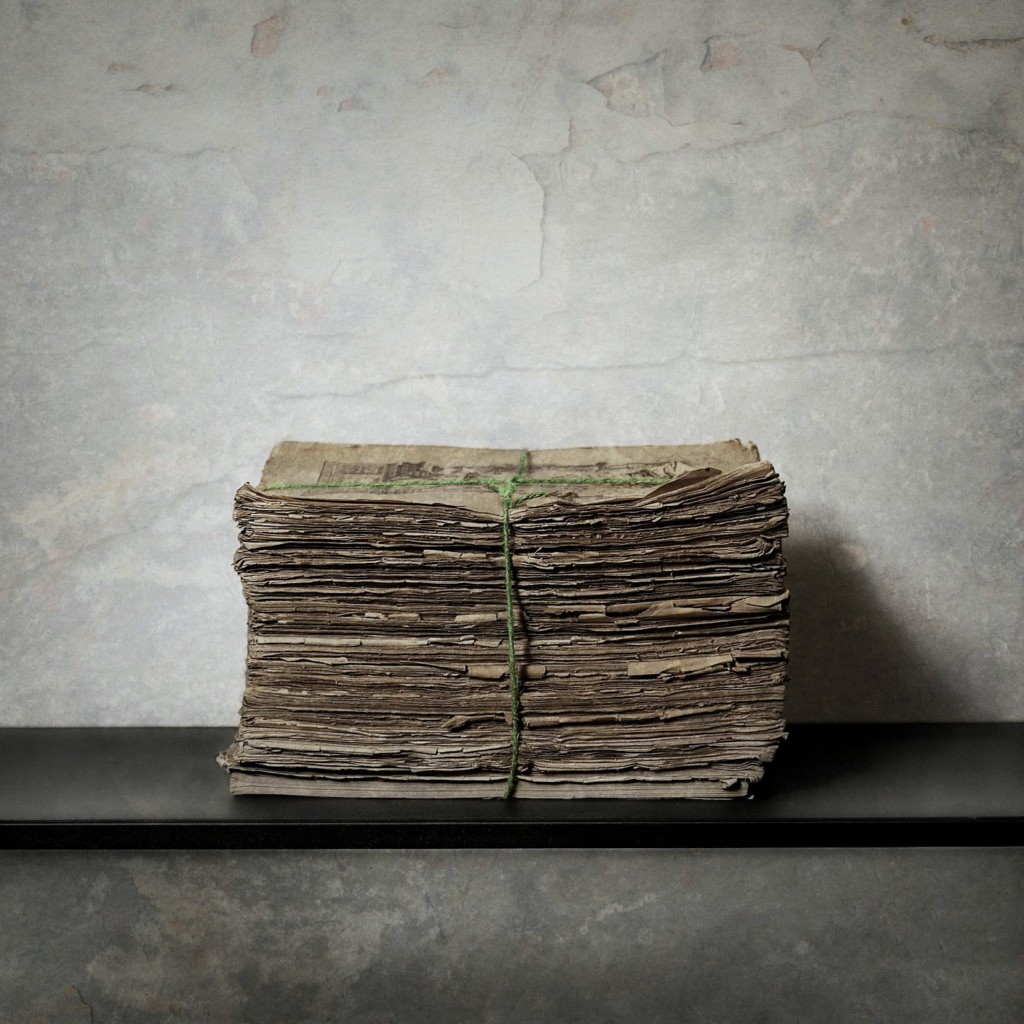

Reducing the world’s accumulated complexity — businesses, institutions, or cities — to sets of discrete tasks or features requires viewing the world as a computer does: quantifying value, weighing costs against benefits, and disregarding ambiguity. As if the messy analog world was code itself, unbundling frames each desirable feature of the world as an independent module that can operate anywhere without a loss of performance quality. The process rests on a faith that technology can isolate the true value of anything useful, removing it from its context without any loss of utility or desirability. Everything that can’t be valued and compartmentalized in that way — that can’t be conserved in the form of a worthwhile module — is discarded in the course of unbundling it. A newspaper’s localized audience, for example, previously developed a shared sense of identity as a community by reading the same publication every day. But that particular collectivity could only arise from the audience assembled by the bundle. “Community” can’t be broken out as an isolated independent “feature” to be consumed on demand by individual consumers.

“Unbundling” rests on a faith that technology can isolate the true value of anything useful

While assessing the value of a bundle’s individual parts can seem relatively straightforward, it’s harder to quantify the comprehensive value of the bundle itself, and how the whole may equal or exceed the sum of its parts. Many communities that form around a particular medium or institution, like that of a newspaper or a university, aren’t the direct result of any single activity within them. Unbundling offers consumers an illusory bargain: Instead of contributing to funding the broader ecosystem that supports the possibility of fulfilling a particular desire, they can pay for only the part that appears to serve them directly. But that effectively swaps one kind of infrastructure for another, with a corresponding redistribution (or neglect) of that infrastructure’s maintenance costs.

In this sense, unbundling is a form of destruction — “creative destruction,” maybe, but destruction nonetheless. This perspective fails to properly value what doesn’t demonstrate an ability to support itself without any cross-subsidies, and implies that the less measurable benefits latent in ambiguity and adjacency shouldn’t be cultivated. But the texture of everyday life is still mostly made up of such contiguity — the incidental context that surrounds specific goals and tasks in the form of human relationships and aesthetic pleasure. When we unbundle a physical retail store, for example, the pleasant nuances of shopping in person and interacting with other people falls through the cracks. Similarly, streaming music, for all its benefits, deprives us of certain niceties that the album format made possible: the slowly earned appreciation for their more challenging songs and the subtle continuity that links them all together. Those losses currently register as mostly inchoate nostalgia for things like dead malls and the Sunday paper. And while such feelings could be dismissed as mere misremembering of the inconveniences of the past, they also reflect the loss of something that was too subtle to preserve.

Things that have been unbundled rarely remain unbundled for very long. Whether digital or physical, people actually like bundles, because they supply a legible social structure and simplify the complexity presented by a paralyzing array of consumer choices. The Silicon Valley disruption narrative implies that bundles are suboptimal and thus bad, but as it turns out, it is only someone else’s bundles that are bad: The tech industry’s unbundling has actually paved the way for invidious forms of rebundling. The apps and services that replaced the newspaper are now bundled on iPhone home screens or within social media platforms, where they are combined with new things that no consumer asked for: advertising, data mining, and manipulative interfaces. Facebook, for instance, unbundled a variety of long-established social practices from their existing analog context — photo sharing, wishing a friend happy birthday, or inviting someone to a party — and recombined them into its new bundle, accompanied by ad targeting and algorithmic filtering. In such cases, a bundle becomes less a bargain than a form of coercion, locking users into arrangements that are harder to escape than what they replaced. Ironically, digital bundles like Facebook also introduce novel ambiguities and adjacencies in place of those they sought to eliminate, such as anger about the political leanings of distant acquaintances or awareness of social gatherings that happened without you (side effects that are likely to motivate future unbundling efforts in turn).

The Silicon Valley disruption narrative implies that bundles are suboptimal and thus bad. But it turns out only someone else’s bundles are bad

In addition to coercing users, bundling can also deceive, combining components into an appealing whole that seems more valuable than it really is. WeWork (officially “The We Company”) has not only unbundled work itself, providing flexible office space for short-term gigs and nontraditional employment, but it is also a corporate bundle that has created a persistent illusion of value in excess of its reality — an illusion that has only recently begun to fade. Stoller, again, argues that the true business model of WeWork has been “to take inputs, combine them into products worth less than their cost, and plug up the deficit through the capital markets in hopes of acquiring market power later or of just self-dealing so the losses are placed onto someone else.” In doing so, WeWork exploits the difficulty of evaluating a bundle’s holistic merit for its executives’ own benefit, not by destroying that bundle but by further mystifying it.

The desire to unbundle and rebundle the world will persist as digital and financial abstraction produces new ways to shuffle consumer infrastructure while redistributing the costs and benefits to consumers. But despite what the popular narratives of disruption seem to imply, this process is cyclical. We are never any closer to some absolute unbundled state in which everything is finally free from everything else and available at its true independent value. There is no such value.

Instead of accepting a false teleology in which technology makes life ever more convenient and efficient, we can get better at recognizing and appreciating the obscure but valuable aspects of existing bundles, which are most likely at risk of vanishing when the next wave of unbundlers come, and not certain to be re-created once rebundled again. If we can’t learn to preserve that sort of unquantifiable worth but instead cling to a more explicit idea of exchange value, we risk losing anything that can’t seem to stand alone as a monetized product — including our collectivity.